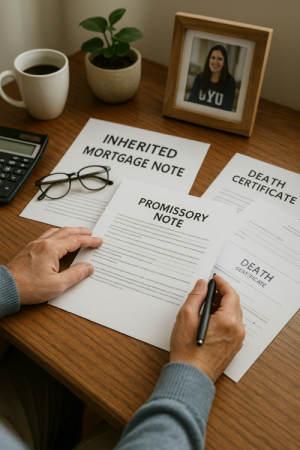

If you’ve ever sold property and allowed the buyer to pay you in monthly installments instead of receiving a lump sum upfront, you’ve created what’s called an owner-financed note. Also known as seller financing or a promissory note, this arrangement can be incredibly valuable—but many note holders don’t fully understand what they own or how it works.

Let’s break it down in plain English.

What Exactly Is an Owner-Financed Note?

Think of an owner-financed note as an IOU with teeth. When you sell property using seller financing, you’re essentially becoming the bank. Instead of the buyer getting a traditional mortgage from a financial institution, they make monthly payments directly to you.

Here’s a simple example: You sell your house for $200,000. Instead of requiring the buyer to get a bank loan, you agree to let them pay you $1,500 per month for the next 15 years. You create a promissory note that legally documents this agreement—the terms, interest rate, payment schedule, and what happens if they don’t pay.

That promissory note is now a valuable asset you own.

How Owner Financing Works in Practice

When you structure a seller-financed deal, several key components come into play:

The Promissory Note serves as the legal contract outlining payment terms, interest rates, and consequences for default. This document is your proof that the buyer owes you money.

The Deed of Trust or Mortgage secures the note against the property itself. If the buyer stops paying, you have legal recourse to reclaim the property through foreclosure.

Monthly Payments typically include both principal and interest, just like a traditional mortgage. These payments represent your ongoing income stream from the sale.

Why Create Owner-Financed Notes?

Seller financing offers compelling advantages for property sellers:

Faster Sales often result because you’re opening your property to buyers who might not qualify for traditional bank financing. This expanded buyer pool can mean selling your property weeks or months sooner.

Higher Sale Prices become possible since you’re providing financing convenience. Buyers often pay a premium for seller financing, especially in competitive markets.

Steady Income Stream provides predictable monthly cash flow. Instead of a one-time payment, you receive regular income that can supplement retirement or other financial goals.

Tax Benefits may apply since you’re spreading the capital gains from your sale over multiple years rather than taking it all at once.

The Hidden Value in Your Note

Many note holders don’t realize they’re sitting on a liquid asset. Your promissory note has real market value that can be converted to cash if your circumstances change.

The value depends on several factors: the creditworthiness of your buyer, the interest rate you set, the remaining balance, and current market conditions. A well-structured note with a reliable payer can be worth 80-90% of its remaining balance in today’s market.

Common Scenarios for Note Creation

Retirement Property Sales: Retirees often use seller financing to sell investment properties or second homes, creating steady income streams for their golden years.

Inherited Property: When you inherit property you don’t want to keep, seller financing can help you sell quickly while creating ongoing income.

Investment Property Exits: Real estate investors frequently use seller financing to sell rental properties, especially when traditional buyers struggle with financing.

Family Transactions: Parents selling property to adult children often use seller financing to make the purchase affordable while maintaining family relationships.

Building Your Note the Right Way

Creating a valuable note requires attention to detail from the start. Proper documentation protects your interests and maximizes your note’s future value.

Credit Verification of your buyer is essential. While you don’t need bank-level underwriting, understanding your buyer’s ability to pay helps you structure appropriate terms.

Fair Market Interest Rates ensure your note remains competitive and valuable. Rates too low reduce your income and note value, while rates too high may indicate predatory lending.

Clear Legal Documentation protects everyone involved. Working with experienced real estate attorneys ensures your note meets local requirements and stands up in court if needed.

Property Insurance Requirements protect your collateral. Requiring buyers to maintain adequate insurance preserves the property’s value securing your note.

Your Options as a Note Holder

Once you own a promissory note, you have several options depending on your financial needs:

Hold and Collect provides steady monthly income for the note’s full term. This works well if you don’t need immediate cash and want predictable returns.

Sell the Entire Note converts your future payments into immediate cash. This option provides a lump sum you can invest elsewhere or use for major expenses.

Sell Partial Payments allows you to receive some cash now while keeping future payments. You might sell the first 60 payments while retaining ownership of the remaining term.

Understanding Note Value

Your note’s market value reflects what investors will pay for your payment stream. Several factors influence this value:

Payment History matters most. Buyers who consistently pay on time create more valuable notes than those with sporadic payment patterns.

Interest Rate affects value significantly. Notes with higher interest rates typically command higher prices from investors.

Remaining Balance and Term influence value calculations. Longer-term notes with larger balances generally offer more total value.

Property Location and Condition impact the security behind your note. Properties in stable markets with maintained conditions support higher note values.

Making Informed Decisions

Whether you’re considering creating a note through seller financing or evaluating options for a note you already own, understanding your situation is crucial.

If you’re thinking about seller financing, consider your long-term financial goals. Do you need steady income, or would a lump sum serve you better? Are you comfortable with the responsibilities of being a lender?

If you already own a note, regularly evaluate whether holding or selling makes sense for your current situation. Life changes, market conditions, and personal financial needs all factor into this decision.

Moving Forward with Confidence

Owner-financed notes represent powerful financial tools that can benefit both sellers and buyers. When structured properly, they create win-win situations that generate value for everyone involved.

The key is understanding what you’re creating or what you own. Knowledge empowers you to make decisions that align with your financial goals and risk tolerance.

Whether you’re just learning about seller financing or you’re a seasoned note holder, staying informed helps you maximize the value of these unique assets. Remember, you’re not just holding a piece of paper—you’re holding a valuable financial instrument that can adapt to your changing needs.

Ready to explore your options? Reach out to us to learn about understanding your note’s value and your available choices is the first step toward making informed decisions about your financial future.

No responses yet