You’ve successfully created an owner-financed mortgage note—congratulations! You’ve opened a door to steady monthly income while helping someone achieve homeownership. But if you’re wondering how to sell your mortgage note for maximum value, you need to understand what impacts your owner financed note value first.

The truth is, small structural mistakes can cost you thousands when it’s time to sell. As note buyers, we see the most common mistakes when selling mortgage note every day—and they’re completely preventable when you know what to look for.

Let’s walk through the seven most costly pitfalls that can slash your note’s market value, and more importantly, how to avoid them before you learn how to sell your mortgage note.

Mistake #1: Inadequate Down Payment Requirements

The Problem: Accepting less than 10% down payment creates a high-risk note that buyers will heavily discount or reject entirely.

When borrowers have little skin in the game, they’re statistically more likely to default. Note buyers know this, and they price accordingly. This mistake alone can reduce your owner financed note value by 30-40% compared to an identical note with 15% down.

How to Avoid It: Require at least 10-15% down payment, with 20% being ideal for maximum note value. If a buyer can’t meet this threshold, consider alternative structures like lease-to-own arrangements until they can build more equity.

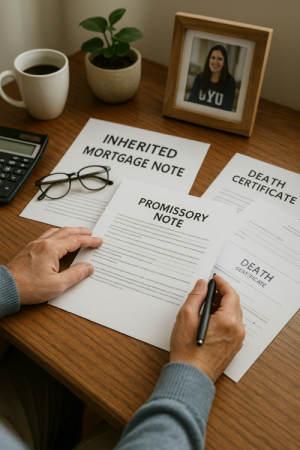

Mistake #2: Poor Documentation and Record Keeping

The Problem: Missing paperwork, unclear terms, or sloppy documentation makes your private mortgage note nearly unsellable.

Note buyers need to see a complete paper trail: promissory note, deed of trust/mortgage, title insurance, property appraisal, and payment history. Missing even one critical document can kill a deal or force you to accept a significantly lower offer.

How to Avoid It: Work with a qualified attorney or title company from day one. Keep meticulous records of all payments, correspondence, and any modifications. Store everything in both physical and digital formats with clear organization.

Mistake #3: Unclear or Unfavorable Terms

The Problem: Vague language, missing clauses, or borrower-friendly terms that leave you exposed.

We’ve seen notes with unclear late fee structures, missing default procedures, and payment terms that make collection difficult. These ambiguities create legal headaches that note buyers simply won’t touch.

How to Avoid It: Include specific language for:

- Late payment penalties and grace periods

- Default procedures and acceleration clauses

- Property maintenance requirements

- Insurance and tax responsibilities

- Clear remedies for non-compliance

Mistake #4: Ignoring the Property’s Investment Appeal

The Problem: Creating notes on properties that institutional buyers won’t want.

Not all properties make good note investments. Rural land, unusual properties, or homes in declining markets create notes with limited buyer appeal. Even if your borrower is reliable, the underlying collateral matters enormously.

How to Avoid It: Stick to traditional residential properties in stable or growing markets. Three-bedroom, two-bathroom homes in established neighborhoods consistently attract the most note buyer interest. Avoid mobile homes, vacant land, or properties with unusual characteristics.

Mistake #5: Not Understanding Your Owner Financed Note Value

The Problem: Setting unrealistic expectations about what mortgage note buyers will pay.

Many note holders expect to sell for 90-100% of remaining balance, but market reality is different. Note buyers must account for risk, time value of money, servicing costs, and potential defaults. Understanding market pricing from the start helps you structure better deals.

How to Avoid It: Before creating your note, research what similar notes sell for in the secondary market. Understanding how to sell your mortgage note at fair market value helps you structure better deals from the start. Generally, well-structured notes sell for 75-85% of remaining balance, depending on risk factors. Price your original transaction with this eventual discount in mind.

Mistake #6: Inadequate Borrower Verification

The Problem: Failing to properly verify your borrower’s ability to pay.

Enthusiasm about making a sale can lead to skipping crucial verification steps. We’ve seen notes created for borrowers with undisclosed debt, unstable employment, or income that barely covers their obligations. These notes are nearly impossible to sell at favorable terms.

How to Avoid It: Treat borrower qualification seriously:

- Verify employment and income with documentation

- Run comprehensive credit checks

- Calculate debt-to-income ratios (keep total debt under 43%)

- Check references and rental history

- Consider requiring a co-signer for marginal borrowers

Mistake #7: Creating Notes That Are Too Small or Too Large

The Problem: Note amounts that fall outside the “sweet spot” for institutional buyers.

Very small notes (under $50,000) often aren’t worth the administrative costs for large buyers, while very large notes (over $500,000) may exceed single buyer comfort levels. Both scenarios limit your potential buyer pool.

How to Avoid It: Aim for note balances between $75,000-$400,000 when possible. This range attracts the most buyer interest and competition, leading to better offers. If you must go outside this range, understand that you may need specialized buyers or longer marketing periods.

The Bottom Line: Avoid These Mistakes When Selling Your Mortgage Note

Every mistake on this list is preventable with proper planning and professional guidance. The cost of getting expert help upfront—whether from attorneys, title companies, or experienced mortgage note buyers—is minimal compared to the value you’ll lose on a poorly structured note.

Remember, you’re not just creating a monthly payment stream; you’re creating a financial instrument that may need to be sold someday. Structure it with that end goal in mind, and you’ll maximize your options and your returns.

Ready to Review Your Note?

Whether you’re planning to create a new note or wondering about the value of an existing one, we’re here to help. Our team reviews note structures every day, and we know exactly what makes notes valuable in today’s market.

Get your free, no-obligation note review today. We’ll analyze your documentation, terms, and market position—then provide honest feedback about your note’s strengths and any areas for improvement. No sales pressure, just expert insights to help you make informed decisions.

Contact YBG Funding today for your complimentary note evaluation. Because the best time to fix note problems is before they cost you money.

No responses yet