Inheriting a mortgage note can feel overwhelming, especially when you’re already dealing with the complexities of probate and estate settlement. Many heirs discover they own a valuable financial asset but aren’t sure what it is, how it works, or what to do with it.

If you’ve inherited a mortgage note, you have options. This guide will walk you through everything you need to know about selling an inherited mortgage note and maximizing its value during what may already be a challenging time.

What Exactly Is an Inherited Mortgage Note?

A mortgage note is a legal document that represents a loan agreement between a borrower and lender. When someone sells property using owner financing (also called seller financing), they become the note holder—essentially acting as the bank.

When you inherit a mortgage note, you’re inheriting the right to receive those monthly payments. However, many heirs prefer to convert this future income stream into immediate cash, especially when dealing with:

- Probate expenses and legal fees

- Estate taxes or debts that need immediate payment

- The desire to divide assets equally among multiple beneficiaries

- Uncertainty about managing a long-term financial asset

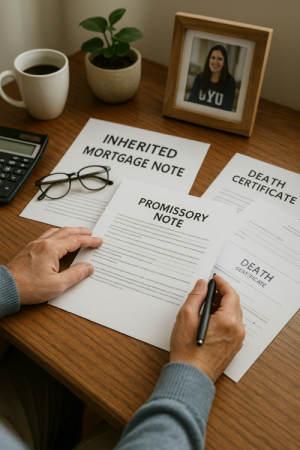

Step 1: Gather All Note Documentation

Before you can sell your inherited mortgage note, you need to locate and organize all the relevant paperwork. The probate process may have already uncovered some of these documents, but make sure you have:

Essential Documents:

- The original promissory note

- The deed of trust or mortgage document

- Payment history records

- Property deed and title information

- Any modifications or amendments to the original agreement

- Borrower contact information

Probate-Related Documents:

- Letters testamentary or letters of administration

- Court orders authorizing the sale (if required)

- Death certificate of the original note holder

Many note buyers will request these documents upfront, so having them organized will speed up the evaluation process significantly.

Step 2: Understand Your Note’s Current Value

Several factors determine how much your inherited mortgage note is worth in today’s market:

Payment Performance: Notes with consistent, on-time payments are worth more than those with irregular payment history. If the borrower has been making payments reliably, this increases your note’s value.

Remaining Balance vs. Property Value: The loan-to-value ratio matters. If the remaining balance is significantly lower than the current property value, you have more security, which translates to a higher selling price.

Interest Rate: Higher interest rates generally make notes more valuable to investors, especially in today’s market environment.

Remaining Term: The time left on the note affects its value. Shorter remaining terms often command higher prices as a percentage of remaining balance.

Property Condition and Location: The underlying property’s condition, location, and market trends in that area all impact the note’s security and value.

Step 3: Decide Between Full Sale vs. Partial Sale

You don’t have to sell your entire note. Understanding your options helps you make the best decision for your situation:

Full Note Sale: You sell the entire remaining balance and receive a lump sum. This is often preferred during probate when you need to settle the estate quickly or divide assets among heirs.

Partial Note Sale: You sell a portion of the future payments while retaining ownership of the rest. This might work if you need some immediate cash but want to maintain future income.

Payment Stream Sale: You sell a specific number of future payments, then the note reverts back to you. This is less common but can be useful in specific situations.

For most heirs dealing with probate, a full sale offers the simplicity and closure needed during an already complex time.

Step 4: Get Multiple Quotes and Compare Offers

Not all note buyers are created equal. The offer you receive can vary significantly based on the buyer’s investment criteria, funding sources, and evaluation methods.

What to Look for in a Note Buyer:

- Quick response time (24-48 hours for initial quotes)

- Transparent pricing with no hidden fees

- Experience with inherited notes and probate situations

- Strong references and industry reputation

- Clear, straightforward purchase process

Questions to Ask Potential Buyers:

- How do you calculate your offers?

- What’s your typical closing timeline?

- Do you handle probate-related documentation?

- Are there any fees I need to pay?

- Can you provide references from other sellers?

Getting multiple quotes helps ensure you’re receiving fair market value for your inherited note.

Step 5: Navigate the Closing Process

Once you’ve selected a buyer, the closing process for an inherited note involves several steps:

Due Diligence Period: The buyer will verify all documentation, confirm payment history, and may order updated property valuations or title work.

Legal Review: Depending on your state and the complexity of the probate situation, you may need court approval for the sale. A qualified note buyer should be able to guide you through any required legal steps.

Closing and Funding: Once all conditions are met, you’ll sign the assignment documents transferring ownership of the note. Funding typically happens within 1-3 business days after closing.

Ongoing Responsibilities: After the sale, you’re typically done with any responsibilities related to the note. The buyer handles all future collection and servicing.

Special Considerations for Inherited Notes

Probate Court Approval: Some states require court approval for the sale of estate assets, including mortgage notes. Your buyer should be familiar with these requirements and help you navigate the process.

Tax Implications: Selling an inherited note may have tax consequences. The good news is that inherited assets typically receive a “stepped-up basis,” which can minimize capital gains taxes. However, you should consult with a tax professional familiar with your specific situation.

Multiple Heirs: If multiple people inherited the note, all parties typically need to agree to the sale and sign the assignment documents. This is another reason why full sales are often preferred—they provide clean closure for everyone involved.

Maximizing Your Note’s Value: Pro Tips

Timing Matters: If the borrower has been making payments consistently and the local real estate market is strong, these factors work in your favor when negotiating a sale price.

Maintain Payment Records: Keep detailed records of any payments received after inheriting the note. Consistent payment history up to the sale date can increase your note’s value.

Property Maintenance: If you have any influence over the property’s condition, maintaining it well helps preserve the note’s security and value.

Market Conditions: Interest rate environments affect note values. Understanding current market conditions can help you decide whether to sell immediately or wait for better conditions.

Common Mistakes to Avoid

Don’t Accept the First Offer: Shopping around for quotes is essential. Offers can vary by 20% or more between different buyers.

Don’t Ignore Probate Requirements: Selling without proper legal authority can create complications. Make sure you have the legal right to sell before proceeding.

Don’t Overlook Documentation: Missing paperwork can significantly delay the process or reduce your offer. Organize everything upfront.

Don’t Rush Without Understanding: While speed is often important in probate situations, take time to understand your options and the value of what you’re selling.

When Professional Help Makes Sense

Consider working with professionals when:

- The probate estate is complex or contested

- Multiple heirs are involved with different objectives

- The note has unusual terms or conditions

- You’re unfamiliar with real estate or financial matters

- Tax implications are significant

Moving Forward with Confidence

Selling an inherited mortgage note doesn’t have to be complicated or stressful. With the right documentation, fair market quotes, and an experienced buyer, you can convert this inherited asset into immediate cash to help settle the estate and move forward with your plans.

The key is working with a note buyer who understands the unique challenges of inherited notes and can guide you through both the financial and legal aspects of the transaction.

Ready to get a fair, no-obligation quote for your inherited mortgage note? Our team specializes in helping heirs navigate the probate process while maximizing the value of their inherited notes. We handle all the paperwork, work with your attorney or probate court as needed, and provide quotes within 24-48 hours.

Have questions about your specific situation? We’re here to help with friendly, expert guidance every step of the way.

No responses yet