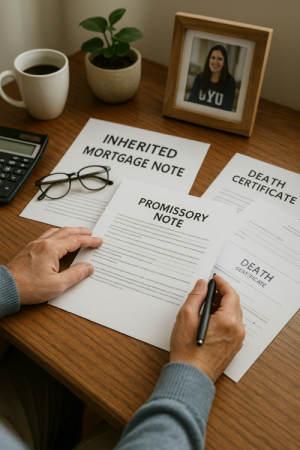

If you’re holding a mortgage note from a property sale or inheritance, you’ve probably wondered: “What’s this actually worth?” Understanding mortgage note valuation is crucial for any note holder considering a sale. Multiple factors determine your mortgage note’s cash offer value, and knowing these valuation factors puts you in control when you’re ready to sell your mortgage note.

At YBG Funding, we’ve evaluated thousands of notes, and we know that informed note holders make better decisions. Let’s break down exactly what determines your note’s value so you can approach any sale with confidence.

Key Factors in Mortgage Note Valuation: Payment Structure

Your note’s payment terms form the backbone of its value. Here’s what matters most in determining your mortgage note worth:

Payment Amount and Frequency The monthly payment amount directly impacts your note’s attractiveness to mortgage note buyers. Higher payments generally mean higher cash offers, but consistency matters more than size. A reliable $800 monthly payment often trumps an erratic $1,200 payment with a history of delays.

Interest Rate Your note’s interest rate compared to current market rates significantly affects mortgage note valuation. If you’re holding a note at 8% when market rates are 5%, you’re sitting on a premium asset. Conversely, a 3% note in a 7% market will fetch less than face value when you sell your mortgage note.

Remaining Term The time left on your promissory note creates a balancing act. Shorter terms mean faster payoff but less total interest. Longer terms provide more payment stability but extend the investment timeline. Note buyers typically prefer notes with 5-15 years remaining—enough time for solid returns without excessive risk.

How Borrower Quality Affects Your Mortgage Note Value

Your mortgage note is only as strong as the person making payments. Here’s what mortgage note buyers examine when valuing your note:

Credit History and Score A payor with a 750+ credit score significantly boosts your mortgage note’s cash offer value. Even if they’ve had past challenges, a demonstrated pattern of on-time note payments can offset lower credit scores. Mortgage note buyers want confidence that payments will continue.

Income Stability Steady employment history and sufficient income coverage (typically 2-3 times the monthly payment) provide the security that companies who buy mortgage notes seek. Self-employed payors aren’t automatically problematic, but they require more documentation to verify income stability.

Payment Track Record Nothing speaks louder than performance in mortgage note valuation. A payor with 24+ months of consistent, on-time payments can command premium pricing, even with other risk factors present.

Property Impact on Mortgage Note Valuation

The underlying property serves as your note’s collateral and significantly impacts what your mortgage note is worth. Key factors include:

Property Type and Condition Single-family homes in good condition typically yield the highest mortgage note values. Unique properties, fixer-uppers, or commercial real estate often receive discounted cash offers due to resale complexity.

Location and Market Trends A property in a stable or growing market supports higher note values when you sell your mortgage note. Professional note buyers research local employment, school districts, and economic indicators to assess long-term property stability.

Loan-to-Value Ratio The relationship between your note balance and property value matters enormously in mortgage note valuation. A $100,000 note secured by a $200,000 property (50% LTV) offers strong collateral protection. Higher LTV ratios typically result in lower offers.

Market Conditions That Influence Your Note’s Worth

External factors beyond your control still impact your mortgage note’s value:

Current Interest Rates When market rates rise, existing lower-rate mortgage notes become less attractive, potentially reducing cash offers. Conversely, when rates fall, your higher-rate note becomes more valuable to mortgage note buyers.

Economic Climate Economic uncertainty typically leads to more conservative valuations as note buying companies factor in increased default risk. Stable economic periods generally support higher offers when you sell your mortgage note.

Investor Demand The mortgage note buying market fluctuates based on investor appetite. High demand periods can drive competitive offers, while oversupplied markets may depress pricing.

Selling Options: Full vs. Partial Mortgage Note Sales

You don’t have to sell your entire mortgage note. Understanding your options affects valuation:

Full Mortgage Note Sale Selling your complete note provides immediate liquidity but transfers all future benefits to the buyer. This typically offers the highest immediate cash amount when you sell your mortgage note.

Partial Note Sale Selling a portion of payments (like the next 60 payments) provides cash now while retaining future income. This strategy often maximizes total return but requires patience.

Split Funding Some mortgage note buyers offer partial cash now with the remainder paid over time. This can increase total proceeds but extends your involvement with the note.

Documentation Requirements for Accurate Mortgage Note Valuation

Proper documentation significantly impacts your note’s value:

Complete Note Package Well-organized documentation including the original promissory note, deed of trust, payment history, and property information commands higher cash offers. Missing documents create uncertainty and lower mortgage note valuations.

Legal Compliance Mortgage notes that comply with all applicable laws and regulations avoid buyer concerns about enforceability. Non-compliant notes may face significant discounts or rejection from note buying companies.

Maximizing Your Mortgage Note’s Value

Understanding these valuation factors helps you make strategic decisions:

Timing Your Sale If your payor has been making payments for several years with a strong track record, you’re in a good position to sell your mortgage note. Conversely, if they’ve recently missed payments, waiting for improvement might be wise.

Improving Your Position While you can’t change your note’s original terms, maintaining good records, staying current on property taxes and insurance, and keeping communication open with your payor all support higher mortgage note valuations.

Getting Multiple Quotes Different note buyers have varying appetites for risk and different required returns. Shopping your mortgage note to multiple qualified buyers ensures you receive fair market value.

What Is My Mortgage Note Worth? The Bottom Line

Your mortgage note’s value depends on a complex interplay of factors, but they all center on one concept: risk versus return. Mortgage note buyers pay more for notes with lower risk and reliable returns. By understanding these mortgage note valuation factors, you can better assess your note’s worth and make informed decisions about when and how to sell your mortgage note.

Remember, every mortgage note is unique. While these factors provide a framework for understanding value, your specific situation may have nuances that affect pricing. Working with experienced note buying companies who take time to understand your complete picture ensures you receive a cash offer that reflects your note’s true value.

Ready to discover what your mortgage note is worth? The first step is getting a professional evaluation from mortgage note buyers who understand these valuation factors and can explain how they apply to your specific situation.

Ready to unlock your note’s value? Get your free, no-obligation quote in 24-48 hours. Our team at YBG Funding evaluates every factor that impacts your note’s worth and provides clear explanations with every offer. Contact us today to start your evaluation process—you’ll be surprised how simple it can be.

No responses yet